State of the Pet Health Insurance Industry: Incredible Growth and Continuing Opportunities

Double-digit year-over-year growth. 4.41 million pets insured. $2.83 billion in premiums. The pet health industry is one of today’s hottest markets. How can you leverage its popularity as a broker or HR professional?

State of the Pet Health Insurance Industry: Incredible Growth and Continuing Opportunities

How does double-digit year-over-year growth sound? For four consecutive years?

The pet health industry is booming!

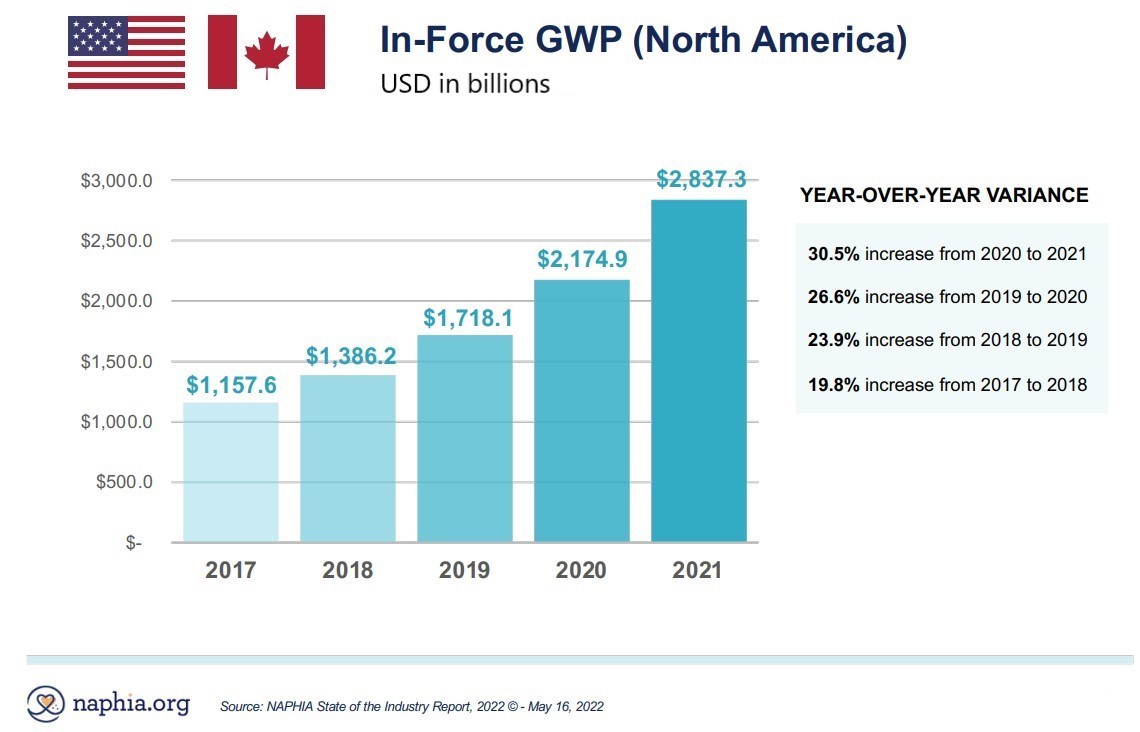

Earlier this month, The North American Pet Health Insurance Association (NAPHIA) published its annual State of the Industry Report. They found that industry growth has more than doubled since 2018!

- $2.837 billion in total in-force premiums in 2021, up over 30.5% from 2020.

- Over 4.41 million insured pets across North America, up 27.7% from 2020.

- Total premium volume in the U.S. was $2.6 billion, up 30.4% from 2020.

Analyzing the trends

What’s fueling the industry’s runaway growth?

Kristen Lynch, Executive Director of NAPHIA, points to a record number of COVID pet adoptions and purchases. Even “post-COVID,” those new pet families continue to enjoy and care for their pets. In addition, the rising cost of living is motivating pet parents to find plans that lower their veterinary bills.

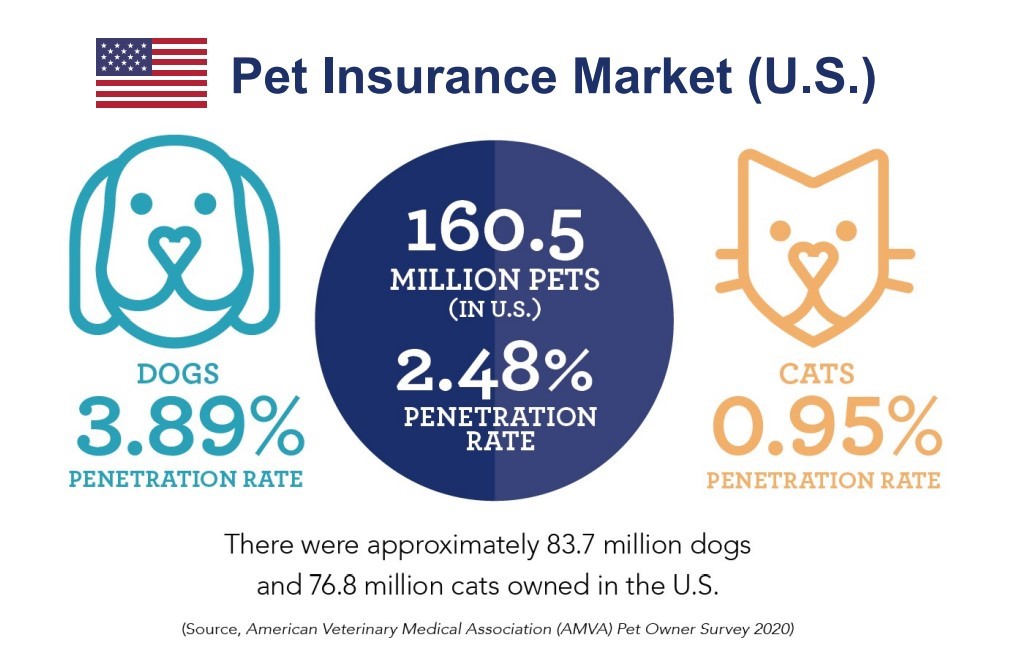

But even with the remarkable increase in insured pets over the past few years, the market is far from saturated. In fact, the national penetration rate for pet health insurance is only 2.48%.

“With approximately 4.4 million pets currently insured, and a total potential market of about 175 million North American pets, there is still considerable room for continued industry growth,” says Rick Faucher, President of NAPHIA’s Board of Directors.

Source: NAPHIA State of the Industry Report, 2022 © - May 16, 2022

Source: NAPHIA State of the Industry Report, 2022 © - May 16, 2022

Finding the opportunities

Given the facts above, pet health insurance can be a significant opportunity for reaching employees with your benefits offering. It’s a desirable, necessary benefit they may not already have from another source.

To reach employees successfully, it’s essential to understand what may be holding them back. Earlier this year, Zeldis Research Associates conducted a Thought Leadership Study, “Consumer Perceptions of Pet Insurance: Caring for the Fur Family.” The study offers insights into:

- What drives consumers to purchase pet insurance

- Barriers to obtaining pet insurance

- The pet insurance purchase and carrier selection process

Based on their research and the NAPHIA SOI 2022, here are five recommendations for increasing pet benefit enrollment rates:

1. Know your market

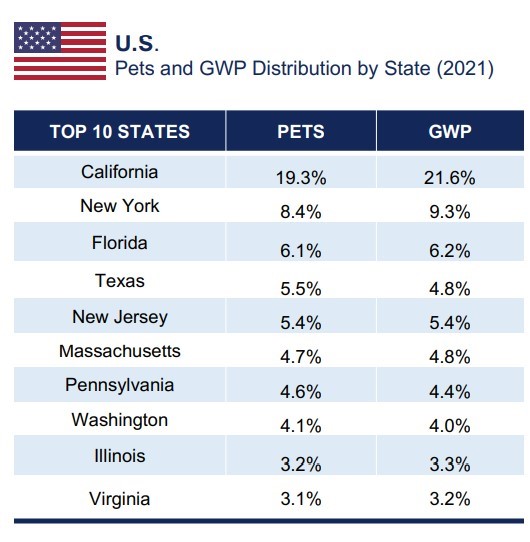

All states are not created equal when it comes to pet insurance. Nearly one-fifth of all insured pets in the U.S. live in California. And there’s a huge gap between California’s 19.3% and second-place New York’s 8.4%. Knowing your state’s penetration rate can direct your internal benefits communications. Are your employees aware of the benefit but just need a small push? Or do they need detailed explanations about the advantages of pet benefits?

Source: NAPHIA State of the Industry Report, 2022 © - May 16, 2022

Source: NAPHIA State of the Industry Report, 2022 © - May 16, 2022

2. Offer multiple options

The Zeldis study offers encouraging statistics for voluntary pet benefits. For example:

- 40% of pet parents without pet benefits have considered pet insurance and recognize the need for it.

- 24% of pet parents without pet benefits said they would purchase pet insurance through an employer.

- 63% of pet parents with pet insurance said that if it was offered as a voluntary benefit, it would increase their satisfaction with their employer.

However, those same folks voiced hesitations over employer-offered benefits, namely being limited to a single option. Pet parents want to shop around and compare plans to pick the best fit for their family.

“Every pet family is unique,” says Rachel Ostreicher, Pet Benefit Solutions (PBS) Chief Operating Officer. “Employees will consider how much they spend on their pets’ care and what they spend on. Their pets’ health and age will factor too. PBS provides multiple options, including flexible pet health insurance plans as well as other wellness plans so employees can choose the type of pet coverage that works best for their situation. And that’s in just a single implementation for employers.”

3. Keep it simple

Zeldis found that the most satisfied pet insurance owners are the ones who understand and, therefore, use their policy. The takeaway may seem to be about the importance of employee education. Education IS important, but what may be more compelling for pet parents is a plan that’s easy to understand.

As one pet parent without pet insurance wrote, “This is something that people want to simplify their lives, not to complicate it more, and it felt to me like it would have complicated my life more.”

70% of pet parents with pet benefits and 50% of pet parents without pet benefits would welcome education about pet health insurance.

2022 Zeldis Research Thought Leadership Study, “Consumer Perceptions of Pet Insurance: Caring for the Fur Family”

Rachel agrees. “Decision fatigue is real! It’s crucial to offer employees plans that are natural, low-stress, and simple. When we designed Wishbone Pet Insurance, our top priority was an intuitive enrollment and claim experience.”

4. Demonstrate Value

Not only should the workings of the plan be transparent, but the value to the pet family should be easy to understand.

- The expense of pet insurance is the top barrier to purchasing it. Therefore, explaining the annual cost savings vs. expenses is especially crucial. Zeldis found that most pet families underestimated their pet expenses by 50% to 150%!

- Pleasantly surprise your employees with a low-premium plan.

- Offer pet wellness plans that include savings on pet products or services, such as prescriptions, preventatives, treats, or toys.

For example, PBS’s Total Pet Plan bundle offers up to 40% member discounts on pet prescriptions, preventatives, toys, treats, food, and more. Free delivery is included and there’s an auto-ship option. Busy pet families can immediately recognize the value in these benefits.

5. Include Well Visits

“I do have pet insurance, but I’ve never actually used it…For the regular visits and the heartworm and stuff, it doesn’t really cover that.”

This quote from the Zeldis study highlights another key finding: many people are dissatisfied with their pet insurance or resist buying it because it doesn’t cover routine care. Offering employees a pet plan that covers those essentials could be a significant driver for sign-ups.

“Today’s pet families know the importance of and prioritize routine healthcare,” says Rachel. “Wishbone Pet Insurance has optional wellness riders to meet those needs, and if traditional insurance isn’t right for a pet family, our Total Pet Plan fills the gaps with coverage for everyday pet care.”